Bankruptcy

DEBT COLLECTORS & ORIGINAL DEBT

Attorney Myers: I’m being sued in small claims court over a debt from a company I never heard of. I know that I have some past bills. I went through a divorce, an illness and a layoff. The name of the company that brought this claim in court against me […]

Bankruptcy Schedules Focus on Key Categories of Filer’s Finances

Bankruptcy schedules, filed with the bankruptcy petition, each focus on one aspect of the filer’s personal finances. There are 10 schedules, each designated with a letter, from A through J. Schedule A – Real Estate Schedule A requires listing of all real estate owned on the date of filing. This […]

BANKRUPTCY: Means Test – Chapter 7

The means test under Bankruptcy Chapter 7 determines whether people are even eligible to file bankruptcy under Chapter 7. Failing the test requires filing a chapter 13, filing no bankruptcy or taking a closer look. First Step To Chapter 7 Means Test The first step is simple math. Add all […]

Too Broke To Go Bankrupt

I didn’t make up the title. Those words headline a CNN Money Magazine article on May 7, 2012. Quoted sources explain how the cost of filing bankruptcy steadily increased after passage of bankruptcy “reform” by the U.S. Congress in 2005. The so-called “Bankruptcy Abuse Prevention and Consumer Protection Act”, or […]

Discharge of Student Loans in Bankruptcy: Exception to Rule

Discharging student loans in bankruptcy occurs only as an exception to the rule. Chapter 7 bankruptcy discharges garden variety unsecured debt, largely credit cards. But, student loans are different. To discharge student loans there must be proof that payment imposes an undue hardship as defined in bankruptcy law. Many courts […]

Bankruptcy: Moral? Ethical?

Guilt. Feelings of doing something against core beliefs. These and other reservations sometimes come up in thinking about filing bankruptcy. Is it ethical? Is it moral? Let’s start here: bankruptcy concepts are firmly embedded in the Bible: “At the end of every seven years you shall grant a release. And this […]

Bankruptcy: Student Loan Debt Crisis

Student Loan debt in the United States, now at $1 Trillion Dollars, is called “the next debt bomb” for the U.S. Economy. Total U.S. student loan debt now exceeds the volume of credit card and auto loan debt combined according to the Associated Press. The head of the National Association […]

How Can Credit Cards Charge Such High Interest Rates?

How can credit card companies charge 30% interest? Didn’t there used to be laws limiting what interest rates companies could charge? This is outrageous. States can and do have “usury laws” limiting the amount of interest that can be charged by lenders. The problem for consumers is a 1978 U.S. […]

Debt Collection Abuse. Legal Constraints on Collection

Debt piles up due to loss of employment, illness and other life events. Outrageous interest rates, charges and fees are enough. But, over aggressive bill collectors top it off. Rude tactics at all hours violate the law. Abusive Debt Collection Federal law prohibits abusive debt collection. This is conduct by debt collectors […]

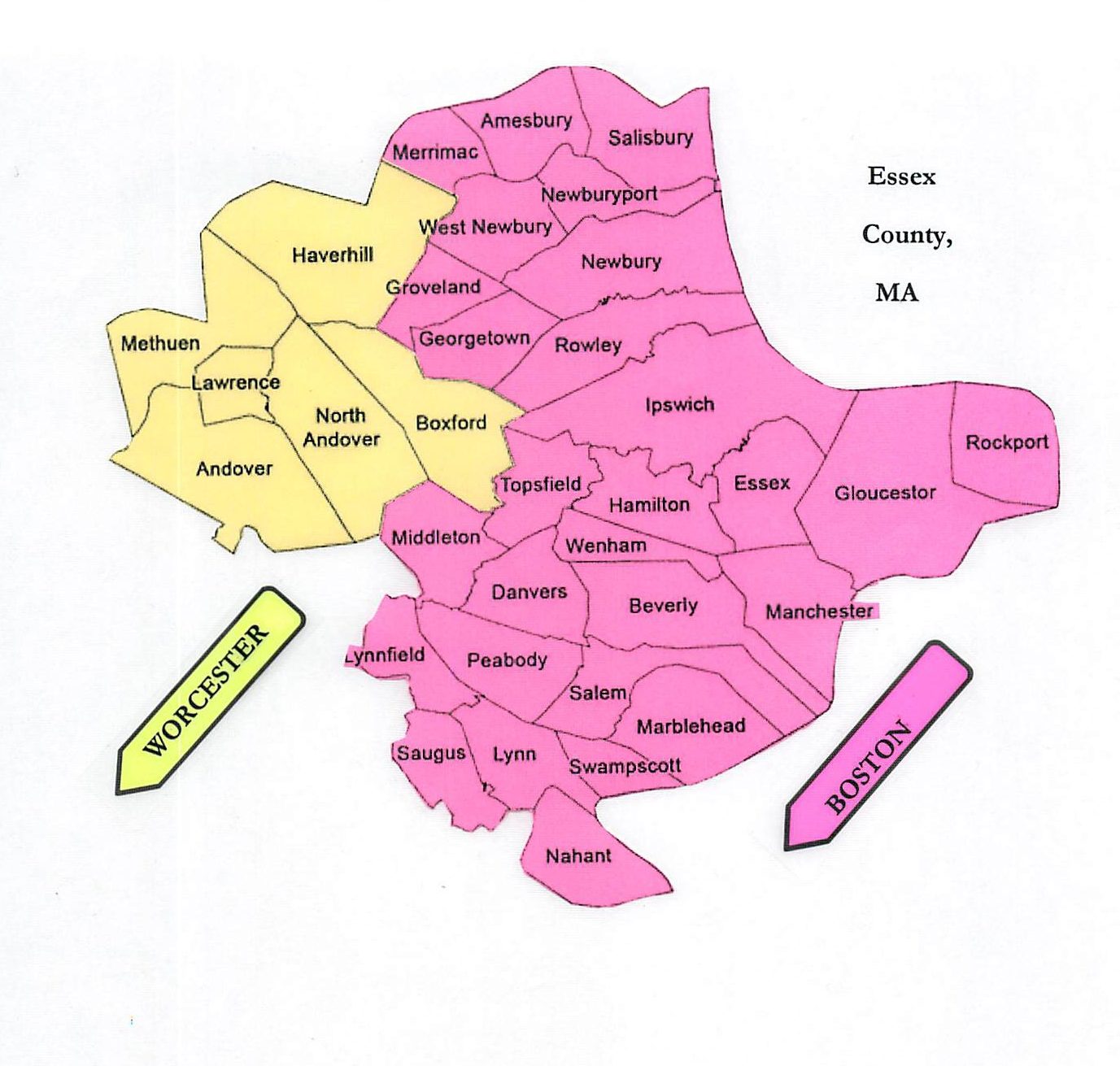

Bankruptcy: Essex County, MA

Where do we go for the creditors meeting after filing bankruptcy? That’s a good question if you live on the Massachusetts north shore, specifically in Essex County. Bankruptcy filers in Lawrence file petitions and attend creditors meetings in Worcester, MA. However, those who file 19 miles away in Salem, […]