Tag: bankruptcy lawyer

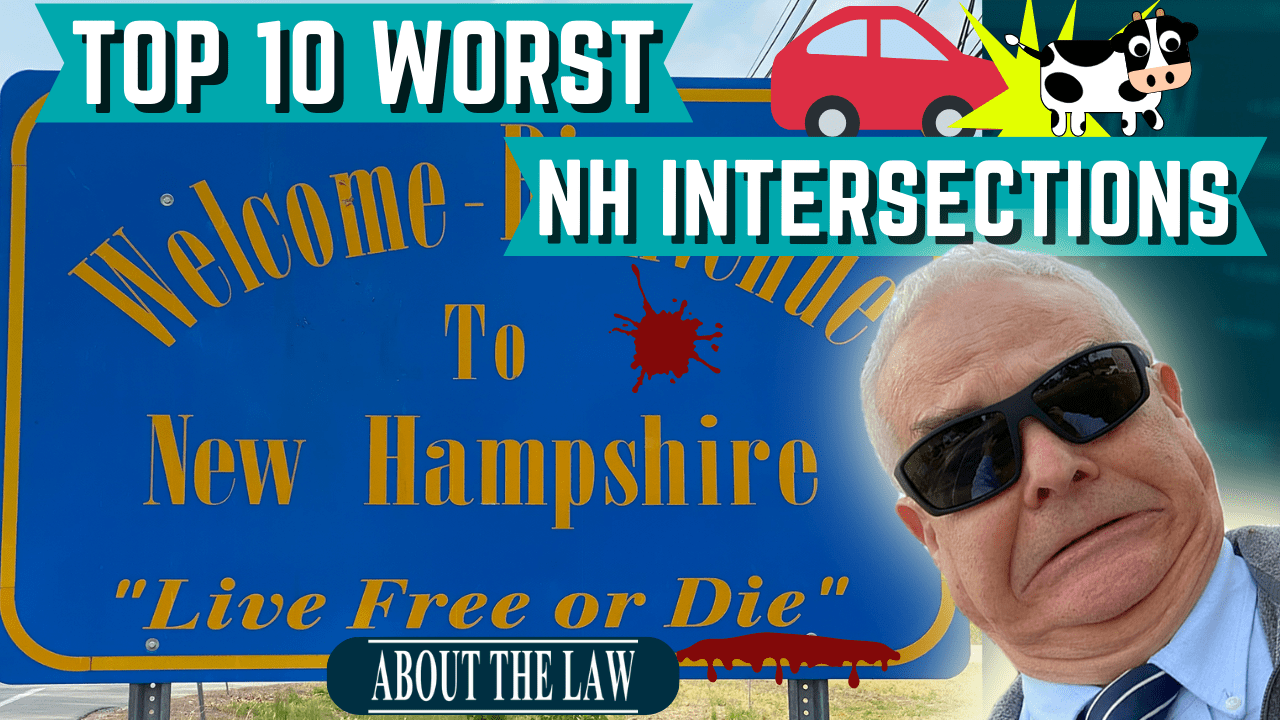

10 Worst Intersections in New Hampshire

The 10 worst intersections in New Hampshire cause car accidents and stress. Their location may surprise you. When our camera crew visited these sites, people who drive here confirmed accidents at these locations. Two bicyclists said they avoid one of the intersections or need patience to wait for heavy traffic. […]

Bankruptcy Questions: What do you need to know?

How do I file for bankruptcy? Bankruptcy facts, not the stuff people say about it, might help people who are struggling financially, and wondering “How can I get myself out of this hole and be able to reclaim my life?” Let’s talk about bankruptcy in a way that’s a little […]

Before Filing Bankruptcy: What to do, What to Avoid.

Before filing bankruptcy think about taking steps to make sure your case goes smoothly. If all goes well in a chapter 7 bankruptcy, unsecured debt, including typical credit card debt, goes away in just under 4 months. Can you keep your favorite credit card? Are one or two credit card […]

Surrendering a Car in Bankruptcy: The Best Option For You?

Surrendering a car in bankruptcy means you give up the car. But, the chapter 7 surrender also means the loan goes away. People often ask me if they can keep their car if they file bankruptcy. And if they have a modest car without a lot of “equity”, the answer […]

FICO Credit Score: New Scoring System Helps Some Borrowers

FICO credit scores mean everything to anyone applying for a loan. The company behind FICO plans a new way to calculate the score for some in 2019. Whether it’s a credit card, a car loan or a mortgage chances are the lender looks at your FICO score to figure out […]

Homestead Protection: Amounts Covered Vary by State

Think of “homestead” and you might envision a scenic home representing a historical residence or grand family estate. In the legal world, homestead law protects equity in a home from being taken by creditors. Such protections exist in state law. Nearly every U.S. state has its own homestead statute, designed to […]

Collections Supposed to Stop After Bankruptcy: Computer Did It Defense

Collections are supposed to stop after you file bankruptcy. Bankruptcy law imposes an automatic stay, effectively a federal court injunction ordering credit card companies, bill collectors, collection attorneys, banks and others to stop all collection activity. Even collection law suits filed to collect debts must stop under the automatic stay […]

Trusts and Bankruptcy: Does A Trust Protect Property in Bankruptcy?

Sometimes people put money in a trust, thinking it’s like a lockbox. Out of reach of liabilities including creditors in a bankruptcy filing. Is that true? Trust as a Lockbox? The ‘lockbox’ idea is somewhat common. But there are many different types of trusts. The individual terms of each define […]

Can I Ever Get Credit After Bankruptcy?

New loans and credit cards may present less of a challenge than you’d think after bankruptcy. But there’s a lot to think about before bankruptcy filers drag themselves down with new loans. Bankruptcy, in the right circumstances, cleans the slate for a new financial life. The U.S. Supreme Court explained […]