Tag: chapter 13

Too Broke To Go Bankrupt

I didn’t make up the title. Those words headline a CNN Money Magazine article on May 7, 2012. Quoted sources explain how the cost of filing bankruptcy steadily increased after passage of bankruptcy “reform” by the U.S. Congress in 2005. The so-called “Bankruptcy Abuse Prevention and Consumer Protection Act”, or […]

Bankruptcy: Moral? Ethical?

Guilt. Feelings of doing something against core beliefs. These and other reservations sometimes come up in thinking about filing bankruptcy. Is it ethical? Is it moral? Let’s start here: bankruptcy concepts are firmly embedded in the Bible: “At the end of every seven years you shall grant a release. And this […]

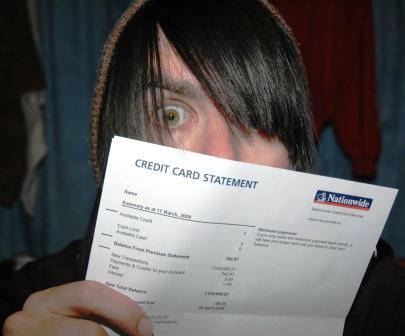

First Meeting With Attorney: Bankruptcy – What To Take

First meeting with attorney: prior to giving advice a bankruptcy attorney needs facts. The more facts provided, the better the quality of the advice. So, here are some basics: Gather Documents Tuck all bills in a folder. Many people don’t even like looking at bills. That’s OK. Put them in […]

What Will The Bankruptcy Trustee Ask at the Creditors Meeting

A bankruptcy trustee is assigned to each petition filed in the bankruptcy court. The trustee conducts a creditors meeting approximately 30 days after Chapter 7 or 13 bankruptcy petitions are filed. But, despite the name, creditors often don’t show up. More important is preparing for questions by the trustee. Take your driver’s license or other government issued photo ID […]

Must I Disclose Income In Bankruptcy?

Potential bankruptcy filers sometimes ask whether they really have to produce their income taxes and pay stubs when they file, isn’t this ‘nosey’ of the bankruptcy court? After a voluntary bankruptcy petition is filed and before the creditors meeting, the person filing must disclose income. The law requires submission of all pay […]

Should I File Bankruptcy? What Basics Should be Considered?

Should I file bankruptcy? Just the thought can overwhelm. Mountains of debt, collections and other pressing issues bring the issue into view, requiring a look at pros and cons. First, calculate how long it will take to pay off your debts. Throw all credit cards in a drawer. Figure how […]

Is Rebuilding Credit After Bankruptcy Possible?

Rebuilding credit after bankruptcy isn’t the easiest thing you’ll ever do. But, if you implement a plan and follow it, you will not be the first person in the world to file bankruptcy and then build a decent credit rating. Car Loan & Bankruptcy If you have a car that […]