Tag: Chapter 7

BANKRUPTCY: Means Test – Chapter 7

The means test under Bankruptcy Chapter 7 determines whether people are even eligible to file bankruptcy under Chapter 7. Failing the test requires filing a chapter 13, filing no bankruptcy or taking a closer look. First Step To Chapter 7 Means Test The first step is simple math. Add all […]

Too Broke To Go Bankrupt

I didn’t make up the title. Those words headline a CNN Money Magazine article on May 7, 2012. Quoted sources explain how the cost of filing bankruptcy steadily increased after passage of bankruptcy “reform” by the U.S. Congress in 2005. The so-called “Bankruptcy Abuse Prevention and Consumer Protection Act”, or […]

Discharge of Student Loans in Bankruptcy: Exception to Rule

Discharging student loans in bankruptcy occurs only as an exception to the rule. Chapter 7 bankruptcy discharges garden variety unsecured debt, largely credit cards. But, student loans are different. To discharge student loans there must be proof that payment imposes an undue hardship as defined in bankruptcy law. Many courts […]

Bankruptcy: Moral? Ethical?

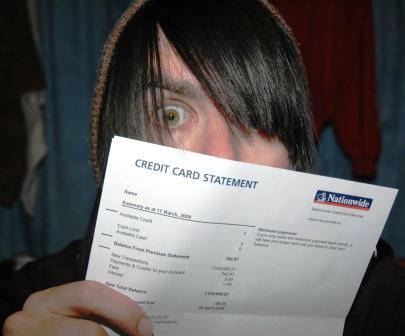

Guilt. Feelings of doing something against core beliefs. These and other reservations sometimes come up in thinking about filing bankruptcy. Is it ethical? Is it moral? Let’s start here: bankruptcy concepts are firmly embedded in the Bible: “At the end of every seven years you shall grant a release. And this […]

Bankruptcy Basics: Chapter 7, Chapter 13

There are two basic types of consumer bankruptcy, Chapter 7 and Chapter 13. Chapter 7 cancels or “discharges” many types of debt. Most credit card, medical, and other unsecured debts are discharged, as are most court judgments and loans. Many filers find all of their debts discharged. Debts not discharged […]

First Meeting With Attorney: Bankruptcy – What To Take

First meeting with attorney: prior to giving advice a bankruptcy attorney needs facts. The more facts provided, the better the quality of the advice. So, here are some basics: Gather Documents Tuck all bills in a folder. Many people don’t even like looking at bills. That’s OK. Put them in […]

What Will The Bankruptcy Trustee Ask at the Creditors Meeting

A bankruptcy trustee is assigned to each petition filed in the bankruptcy court. The trustee conducts a creditors meeting approximately 30 days after Chapter 7 or 13 bankruptcy petitions are filed. But, despite the name, creditors often don’t show up. More important is preparing for questions by the trustee. Take your driver’s license or other government issued photo ID […]

Bankruptcy Case Timeline

Chapter 7 bankruptcy cases travel along a track, much like a train. Unless unforeseen problems get in the way, the cases generally stay pretty much on schedule. Here is the timeline, listing main events in a typical chapter 7 case. Credit Counseling Prior to filing, every debtor must take this, […]

Must I Disclose Income In Bankruptcy?

Potential bankruptcy filers sometimes ask whether they really have to produce their income taxes and pay stubs when they file, isn’t this ‘nosey’ of the bankruptcy court? After a voluntary bankruptcy petition is filed and before the creditors meeting, the person filing must disclose income. The law requires submission of all pay […]

Should I File Bankruptcy? What Basics Should be Considered?

Should I file bankruptcy? Just the thought can overwhelm. Mountains of debt, collections and other pressing issues bring the issue into view, requiring a look at pros and cons. First, calculate how long it will take to pay off your debts. Throw all credit cards in a drawer. Figure how […]